Customer Churn Analysis - Zenith Digital Bank

1. Challenge:Defining the problem Zenith Digital Bank needed to solve.

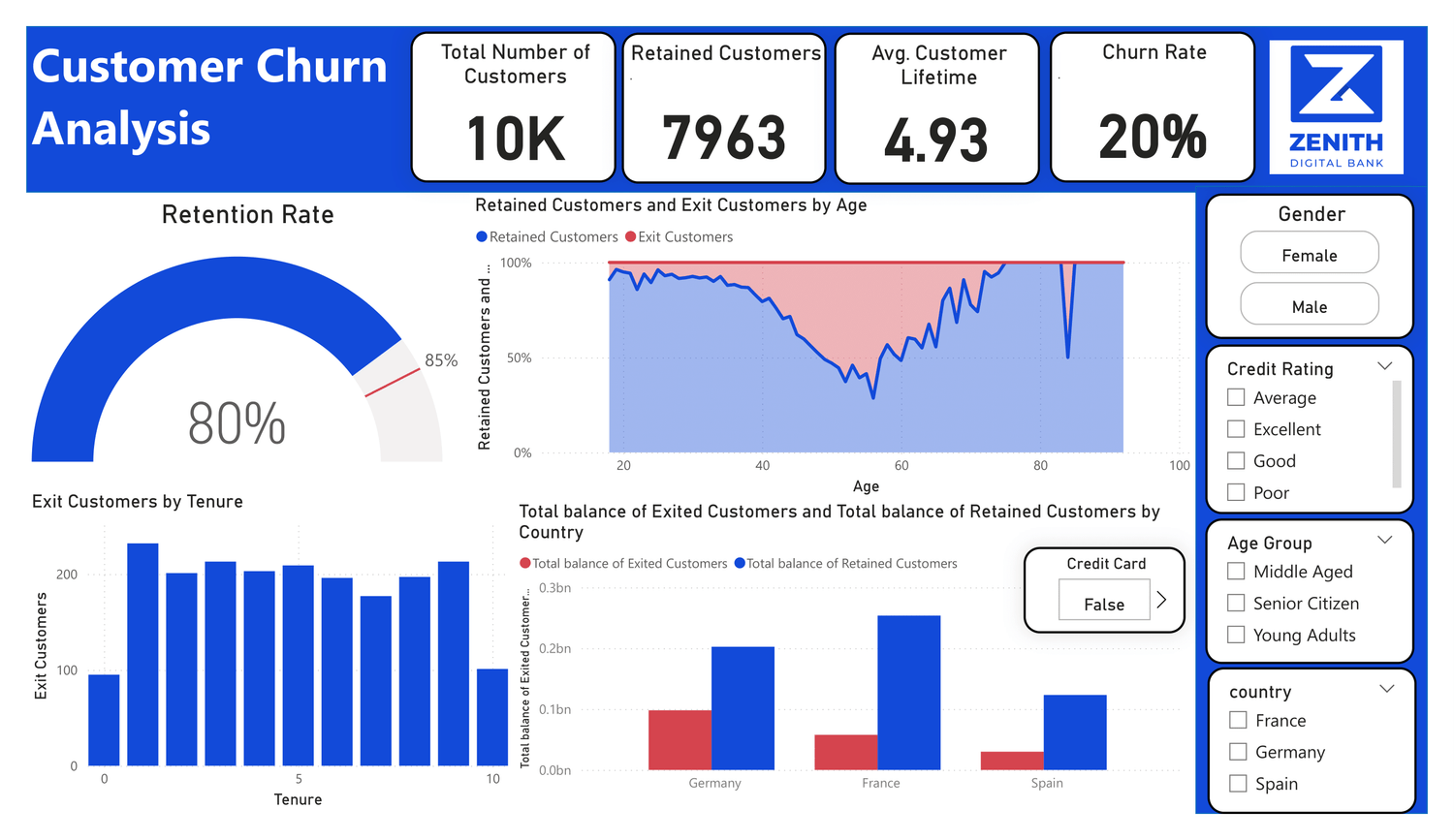

Zenith Digital Bank experienced a 20% customer churn rate (80% retention), requiring an understanding of the factors driving this attrition to implement effective retention strategies. The bank needed to pinpoint specific customer demographics, account characteristics, and behavioural patterns associated with churn to target at-risk customers with appropriate interventions.

2. My Solution:The analytical approach I took to address the challenge.

To address this challenge, I employed a multi-stage analytical approach leveraging both Excel and Power BI.

Initial Data Exploration (Excel): I began by exploring the provided data within Excel to gain a preliminary understanding of the variables and their distributions. This included calculating descriptive statistics, such as averages, medians, minimums, and maximums for key metrics like salary, balance, age, and tenure. Additionally, I examined the distribution of categorical variables like gender, credit rating, and age group. This basic analysis, the results of which are visible in the attached image, provided an initial framework for understanding potential relationships within the data.

Data Preparation and Transformation (Power Query): Next, I imported the raw data into Power BI utilizing Power Query for robust data cleaning and transformation. This involved standardizing data formats, handling any missing values, and creating calculated columns to derive insightful metrics. I also grouped age into relevant bins (e.g., Young Adult, Middle-aged, Senior Citizen) and categorized credit scores into ranges (e.g., Poor, Average, Good, Excellent) to facilitate more effective analysis.

Interactive Dashboard Development (Power BI): Building upon the foundation laid in Excel and refined in Power Query, I developed an interactive Power BI dashboard to visualize key findings clearly and concisely. The dashboard showcased the overall churn rate, churn rate broken down by demographics and account attributes, and identified the primary drivers influencing customer churn. Interactive elements like slicers and filters were incorporated to empower users to explore the data dynamically.

Insight Generation: Through analysis of the Power BI dashboard, I extracted actionable insights and trends concerning customer churn, enabling Zenith Digital Bank to understand which customer segments were most susceptible and which factors had the strongest impact on their decisions to leave.

3. Key Insights:The actionable discoveries I made through my analysis.

The analysis yielded the following critical insights:

Age: Middle-aged customers, particularly those in the 50-60 age range, demonstrated a higher propensity to churn.

Credit Score: Customers with lower credit scores, specifically those below 550, exhibited a greater likelihood of churning, especially when coupled with the Age Group of senior citizens.

Average Customer Lifetime: On average a customer stayed for 4.93 years with the bank before leaving.

Account Balance: Surprisingly, customers holding high account balances (100-150k) presented a higher churn rate followed by customers with zero balances.

Tenure: It didn't have a significant impact on churn, it was almost evenly spread out.

Products: Customers utilizing fewer bank products, notably those in product group 1, showed a higher tendency to churn.

Location: Churn rates varied across countries. In Germany, the retention rate for female customers was 62% (churn 38%), significantly lower than the 72% (churn 28%) retention rate for male customers and extremely low compared with overall retention.

Gender: Females had a lower retention rate compared to males to be precise it was 9% lower than males.

These insights equip Zenith Digital Bank with a clear understanding of its customer churn landscape, highlighting vulnerable segments and influential factors. This information serves as a strong foundation for developing targeted retention strategies and interventions to effectively mitigate churn.

YOU MIGHT LIKE

© Hrishikesh 2025. All rights reserved.

About me

Beyond the spreadsheets and dashboards, I'm a lifelong learner, always eager to explore new technologies and expand my skills, fueled by a passion for both data analysis and a good story (whether it's in a comic or a dataset).